Asset Financing Loan

The Asset Financing Loan Product is for members of Plan International Sacco who wish to acquire incomec generating (Business) assets e.g. machinery ,equipment and /or purchase of rental units

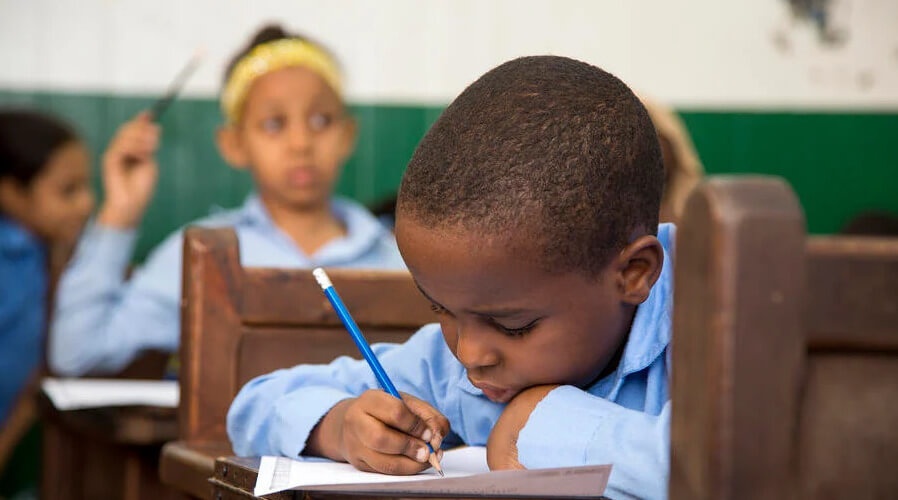

Education Loan

The product aims to connect with Plan International Sacco members by encouraging them to provide quality education by starting early to save and then borrow for their education as a mechanism to secure their future.

Housing Loan (Tuzimbe)

The Luganda word, “Tuzimbe, aims to connect with Plan International Sacco members by a clear meaning of the product, ‘Tuzimbe’ is for housing and points to the need for the members to secure their future by investing in constructing house now

Motor Vehicle Loan

The product aims to connect with Plan International Sacco members by enabling them to acquire Motor vehicles for domestic (personal use) to ease their movements and not for income generation